EDF (the “Company”) today announces the results of the tender offers launched on 26 November 2019 (1) (the "Tender Offers") to purchase the following hybrid notes (together, the “Targeted Hybrid Notes”):

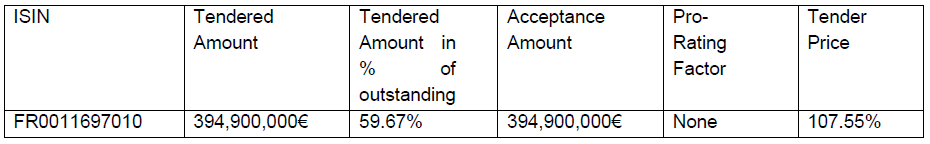

1. EUR 1,000 million Reset Perpetual Subordinated Notes with a first redemption at the option of the Company on 22 January 2022 (ISIN: FR0011697010) of which EUR 661.8 million is currently outstanding, which are admitted to trading on Euronext Paris (the “Euro Notes“); and

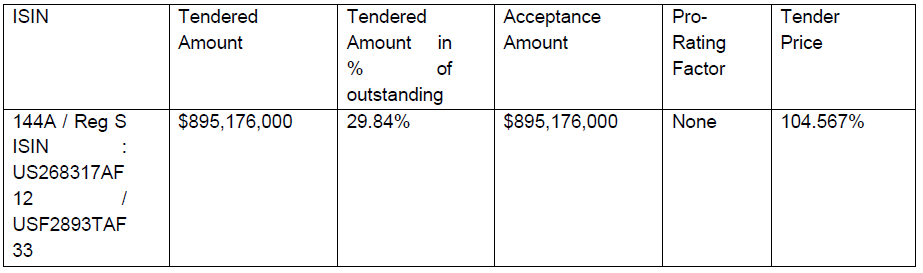

2. USD 3,000 million Reset Perpetual Subordinated Notes with a first redemption at the option of the Company on 29 January 2023 (144A / Reg S ISIN: US268317AF12 / USF2893TAF33) of which USD 3,000 million is currently outstanding, which are admitted to trading on the regulated market of the Luxembourg Stock Exchange (the “US Notes“).

Summary table of the Tender Offer results in respect of the Euro Notes below:

EDF will purchase for cash Euro Notes validly tendered pursuant to the Tender Offer on 13 December 2019.

Summary table of the Tender Offer early participation results in respect of the US Notes:

Holders whose US Notes are accepted for purchase will receive the tender price. The settlement date for the US Notes accepted for purchase by the Company is expected to be 13 December 2019.

The Tender Offer relating to the US Notes will continue until 27 December 2019.

The Company also intends to exercise its call option on January 29, 2020 on all the 1,250 billion euros of indefinite subordinated bonds (ISIN: FR0011401736), the amount of which is currently outstanding to 338.2 million euros.

As a consequence, and taking into account the Euro-denominated 500 million hybrid note offering, at 3.00% coupon with a 8-year first call date launched on November 26, 2019, these transactions will allow to reduce the total stock of hybrids on EDF's balance sheet by approximately 9% to 9.2 billion euros while making a net coupon savings of around 44 million euros in 2020 and around 58 million euros from 2021.

(1) see EDF's press release dated 26 November 2019.

Disclaimers

This announcement does not contain the full terms and conditions of the Tender Offers constitute an invitation to participate in the Tender Offers in or from any jurisdiction in or from which, or to or from any person to or from whom, it is unlawful to make such invitation under applicable securities laws. The distribution of this announcement in certain jurisdictions may be restricted by law. Persons into whose possession this announcement comes are required to inform themselves about, and to observe, any such restrictions.

This announcement must be read in conjunction with the offer to purchase for the respective Targeted Hybrid Notes. Tenders of Targeted Hybrid Notes for purchase pursuant to the tender offer will not be accepted from qualifying holders in any circumstances in which such offer or solicitation is unlawful. EDF does not make any recommendation as to whether or not qualifying holders should participate in the tender offer. This announcement and the offer to purchase for the respective Targeted Hybrid Notes contain important information which should be read carefully before any decision is made with respect to the New Notes or the Tender Offers. If any holder of the Targeted Hybrid Notes is in any doubt as to the contents of the offer to purchase for the respective Targeted Hybrid Notes or the action it should take, it is recommended to seek its own financial advice, including in respect of any tax consequences, from its broker, bank manager, solicitor, accountant or other independent financial, tax or legal adviser.

The tender offer for the Euro Notes is not being made and will not be made directly or indirectly in or into, or by use of the mails of, or by any means or instrumentality of interstate or foreign commerce of, or of any facilities of a national securities exchange of, the United States to owners of the Euro Notes who are located in the United States as defined in Regulation S of the U.S. Securities Act of 1933 (as amended, the “Securities Act”) or to U.S. Persons as defined in Regulation S of the Securities Act (each a “U.S. Person”). The Euro Notes may not be tendered in the tender offer by any such use, means, instrumentality or facility from or within the United States, by persons located or resident in the United States or by U.S. Persons. Accordingly, copies of this document and any other documents or materials relating to the tender offer for the Euro Notes are not being, and must not be, directly or indirectly, mailed or otherwise transmitted, distributed or forwarded (including, without limitation, by custodians, nominees or trustees) in or into the United States or to any such U.S. Person. Any purported offer to sell in response to the tender offer for the Euro Notes resulting directly or indirectly from a violation of these restrictions will be invalid, and offers to sell made by a person located in the United States or any agent, fiduciary or other intermediary acting on a non- discretionary basis for a principal giving instructions from within the United States or any U.S. Person will be invalid and will not be accepted. Each holder of any Euro Note participating in the tender offer will represent that it is not located in the United States.

Analysts and investors

+33 (0) 1 40 42 40 38