EDF Pulse Ventures, the EDF Group's corporate venture capital, is carrying out a deep dive into EDtech and HRtech startups.

While the latest IEA studies predict the creation of 8 million jobs in the renewable energy sector by 2030, industry professionals are warning of a shortage of workers available on the market. According to a BCG study, there will be a shortage of 7 million people working in the energy transition sector by 2030.

EDF is no exception to this trend. With a need for 6,000 to 10,000 new employees in technical professions every year, particularly in the fields of nuclear power, networks and new energy systems (renewable energies, hydroelectricity, energy services), the Group needs twice as many workers as there are profiles available today. Faced with this major challenge to achieve carbon neutrality, EDF Pulse Ventures, the Group's corporate venture capital, looks at innovative EDtech and HRtech solutions.

What are EDtech and HRtech?

EDtech and HRtech bring together players offering technological innovations to meet the challenges of human capital development. EDtech encompasses everything to do with education and training, while HRtech focuses more on the attractiveness of professions, recruitment and talent management.

Both EDtech and HRtech experienced a meteoric rise in 2021 at the time of the COVID pandemic, which encouraged the development of teleworking and the digitalisation of human resources (HR) functions. At the time, solutions were focused on digital professions and white-collar workers.

Since then, market momentum has slowed in this segment. However, in connection with the growing shortage of workers in shortage occupations such as those in the energy transition, we are seeing the emergence of new players specialising in technical occupations, the "blue collars", which are tending to create favourable conditions for the EDF Group to invest in EDtech and HRtech startups.

EDtech and HRtech: the best time to invest in blue-collar solutions according to EDF Pulse Ventures

Several trends identified by EDF Pulse Ventures tend to prove that there is momentum to invest in EDtech and HRtech startups targeting technical professions in order to build a low-carbon world ("green collars").

The first concerns recent regulatory changes, particularly in France, which are leading to tighter CPF controls and a decline in apprenticeship contracts. These measures should redirect current provision towards quality training and shortage occupations, and boost EDtechs specialising in these areas.

Secondly, the nuclear industry recovery plan and the France 2030 reindustrialisation programme both provide several billion euros of funding for energy transition jobs, and are therefore boosting the EDtech and HRtech market.

Finally, recent technological advances, and in particular the advent of AR/VR headsets, sales of which are expected to increase tenfold between 2021 and 2025, and the democratisation of artificial intelligence, are making technical professions more accessible and attractive.

Faced with these opportunities, more and more startups are emerging, enjoying a fine dynamic that has prompted EDF Pulse Ventures to take an interest in three segments in particular.

EDF Pulse Ventures chooses 3 major areas of EDtech and HRtech to develop the attractiveness of energy transition professions

For the EDF Group, as for many industrial companies, the main challenge is to have the right skills at the right time to successfully complete the various projects and accelerate the construction of a low-carbon world.

To meet this objective, EDF Pulse Ventures has identified three relevant investment themes for the Group:

-

Skills development and training

This is the crux of the matter: increasing the number of students in the energy transition professions in order to increase the number of potential workers. Two types of player stand out in this first stage of the value chain: innovative new schools (e.g. La Solive, l'Etincelle), which, like Ecole 42, are making technical professions more attractive again; and training tools/facilitators using VR/AR in form (e.g. Uptale) and artificial intelligence in content (e.g. Nolej).

-

Building a talent pool, acquiring talent

Once the problem of training provision has been resolved, the next step is to attract the right profiles to these types of job and then to the company. In this new phase, two types of players come together: those who create recruitment pools (e.g. Kolverr, Greenworkx), and those who develop tools to match profiles with companies' needs in an efficient, relevant and rapid way (e.g. Goshaba, myjobglasses).

-

HR planning and skills management

Finally, once the talent has been integrated into the company, it is important to allow it to develop and evolve according to the needs and challenges of each project. Two types of solution emerge in the field of GPEC (forward-looking management of jobs and skills): the assessment and mapping of existing skills (e.g. Neobrain, Mercateam) and medium/long-term planning (e.g. Albert).

A hundred startups to follow in EDtech and HRtech

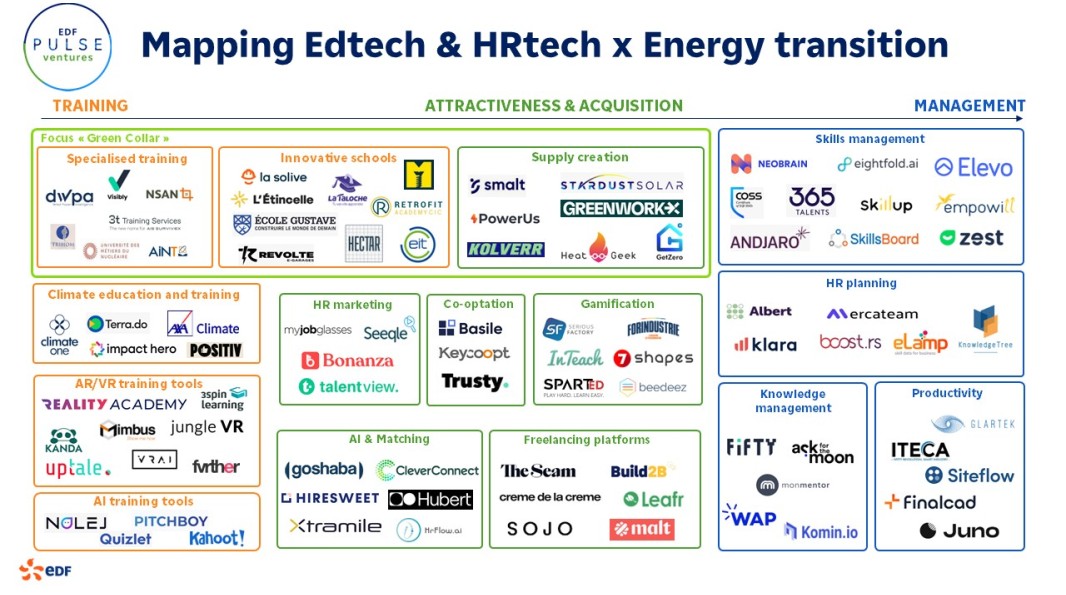

As part of this deep dive, EDF Pulse Ventures has mapped the most promising startups in EDtech and HRtech capable of improving the attractiveness of the energy transition professions: